Advancements in Payment Technologies

There was a time where customers would go to their main market to purchase goods with cash.

Fast forward to the arrival of personal computers in the home, the internet, and the launch of companies such as Amazon, Alibaba Group, and eBay – suddenly a new concept of paying for goods and shopping online was born. This was a game changer.

Today, thanks to such advancements, global retail eCommerce sales are expected to reach $4.5 trillion by 2021. Technology advancements have reinvented commerce and continue to reshape the payments industry every day. Here are 3 advancement routes contributing to the future of the payments industry:

The Dawn of ‘Buy Now, Pay Later’

The likes of Klarna and Quadpay have made it possible for customers to buy products and pay for them later, or in Quadpay’s case, pay in instalments interest-free. Flexibility like this allows for those ‘aspirational’ and expensive purchases to become much more accessible, and allows retailers to expand their reach to customers without sacrificing on revenues. It’s an all-around winning area, and in the current climate of thriftier consumers, this is a real gamechanger for merchants.

Top retail brands like Topshop, JD Sports, and Schuh are just a few of the many high-street retailers jumping on this huge opportunity.

Social Commerce

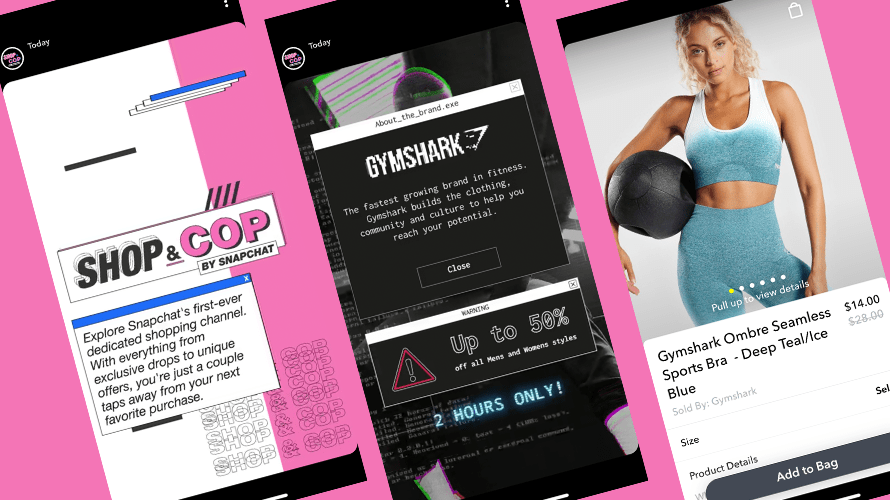

Instagram alone now has 800 million users, with 25 million of those being business accounts. Social media’s growth and its relationship with retailers and consumers has become so intertwined that, for a truly omnichannel experience, making social media platforms shoppable is a necessity.

Allowing consumers to purchase products directly through Instagram or Facebook offers new point-of-sale touchpoints and helps to minimise steps-to-purchase when ordering a product.

Enabling this path to purchase also provides additional benefits for brands. On the analytics side, retailers can gather rich behavioural insights about its customers, which will help shape their future product and market strategies. On the marketing side, the brands are more accessible on social, allowing for customers to interact more freely and help build brand advocates and loyal customers.

British online sports fashion brand Gymshark, has 7 million engaged social media followers across 131 countries, and boasts over 60 million followers with its combined team of “Gymshark Athletes”. Making the brand shoppable on social media platforms has been critical to their success contributing to their £41 million in sales in 2017.

Digital Currency

With the arrival of decentralised digital currencies like Bitcoin, the possibilities in the cryptocurrency world are endless. Not only is Bitcoin seen as a safer method of payment but it’s also faster for transactions. Existing payment methods can typically take anywhere from a few hours to several days to clear. With Bitcoin, the waiting time is eliminated and allows retailers to ship out orders almost immediately.

Additionally, there’s an added layer of security with encryption and blockchain which significantly reduces the risk of fraud. The best part to this is that there is zero interference from financial institutions, which is only going to pave the way for many future consumers to make bitcoin their number one choice for method of payment.

While digital currency hasn’t fully taken off with retailers just yet, some early adopters like Microsoft and Overstock are now accepting Bitcoin. It is only a matter of time until others will follow.

Despite this, and many other advancements, mobile traffic accounts for just over 50% of all eCommerce traffic, but the cart abandonment rate on mobile devices is 85%. Digital currencies are able to eliminate a lot of friction by allowing customers to skip entering billing information, for instance, making the path to purchase a little bit smoother.

New technologies in the payments industry have clearly disrupted the market to the point of no return. This has happened at a really great time, with customer experience demanding new and innovative ways to meet customer expectations online. The fact is that customers today require several payment options with ease of use as a standard.

The ideal customer experience is always changing and the payments industry is one area in eCommerce which is keeping up with the pace.